About this report

The State Tourism Satellite Account (STSA) 2022–23 highlights the importance of tourism to each state and territory. STSA data tables are useful in understanding:

- the value of tourism goods and services consumed by visitors in a state or territory.

- tourism’s contribution to Gross State Product (GSP), exports and jobs.

Tourism Research Australia (TRA) compiled the 2022-23 STSA. This most recent year is compared with earlier years and a time series of results (2006-07 to 2022-23) is presented in the data tables at the end of this summary.

TRA used its internal data (Regional Expenditure) along with the Australian Bureau of Statistics’ (ABS’) Australian Tourism Satellite Account (TSA) data, Labour Accounts Australia data, and State Accounts data as sources for the STSA.

The STSA complements the work of the TSA by examining state and territory tourism performance and estimating the indirect economic and jobs impacts of tourism. The detailed statistical tables that accompany this report also include tourism Gross Value Added (GVA), tourism output and data for different tourism industries.

Read about the terminology we use and how we apply the data in the explanatory notes.

Key findings

During 2022-23 the visitor economy experienced a strong rebound from the COVID-19 pandemic. The industry saw increased visitor numbers, with Australians travelling domestically and more international visitors returning to our shores. However, the recovery in international arrivals has taken longer than domestic travel, including as a result of the earlier international border closures during the pandemic.

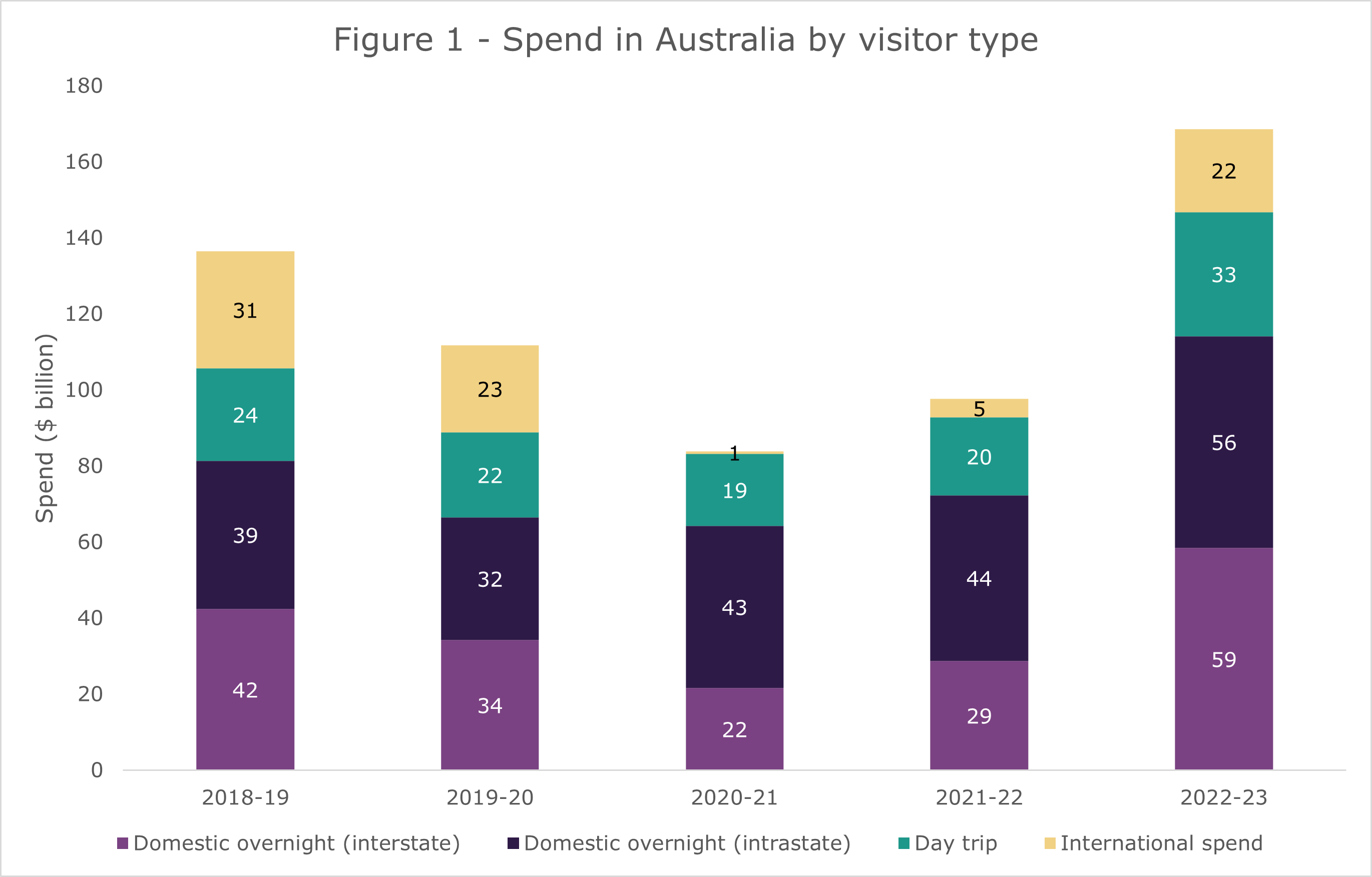

According to TRA national visitor survey (NVS) and international visitor survey (IVS) expenditure data, total tourism demand in the form of short-term visitor spend in Australia in 2022-23 was $169 billion (Figure 1). This was up 73% or $71 billion on 2021-22 and surpassed pre-pandemic (2018-19) levels by 24% or $32.2 billion:

- domestic overnight visitor spend increased 57% on 2021-22 and was 40% higher than its pre-pandemic level

- domestic interstate overnight visitor spend more than doubled from 2021-22 and surpassed 2018-19 levels by 38%

- domestic day trip visitor spend was up 60% on 2021-22 and was 34% higher than its pre-pandemic level

- International visitors spend in 2022-23 increased by 550% on 2021-22 but was still 29% lower than in pre-pandemic level.

Source: TRA IVS and NVS data

Tourism consumption

Tourism consumption was $164.5 billion in 2022-23. With solid domestic travel and international arrivals recovering strongly, tourism consumption was up 71% (or $68.6 billion) on the previous year. The robust growth during 2022-23 led total tourism consumption to exceed the previous peak in 2018-19 by 8% ($12.2 billion).

Tourism consumption improved for all states and territories in 2022-23 when compared with the previous year (Table 1). In order of the strongest growth among the states and territories:

- Australian Capital Territory registered the strongest growth (up 94% or $1.7 billion)

- New South Wales was up 91% (or $23.2 billion)

- Victoria was up 79% (or $16.2 billion)

- South Australia was up 64% (or $4.0 billion)

- Queensland was up 59% (or $15.1 billion)

- Western Australia was up 55% (or $6.1 billion)

- The Northern Territory was up 51% (or $1.1 billion)

- Tasmania was up 33% (or $1.1 billion).

Table 1: Tourism consumption by state and territory, 2022-23

| State | Consumption 2022-23 | Change from 2021-22 | Change from 2018-19 | ||

| $ billion | $ billion | Per cent | $ billion | Per cent | |

| New South Wales | 48.7 | 23.2 | 91% | 2.1 | 4.5% |

| Victoria | 36.6 | 16.2 | 79% | 0.4 | 1.2% |

| Queensland | 40.5 | 15.1 | 59% | 5.9 | 17% |

| South Australia | 10.3 | 4.0 | 64% | 1.3 | 14% |

| Western Australia | 17.2 | 6.1 | 55% | 2.1 | 14% |

| Tasmania | 4.5 | 1.1 | 33% | 0.0 | 0% |

| Northern Territory | 3.3 | 1.1 | 51% | 0.1 | 3.8% |

| Australian Capital Territory | 3.4 | 1.7 | 94% | 0.3 | 11% |

| Total | 164.5 | 68.6 | 71% | 12.2 | 8.0% |

Gross State Product from tourism

Direct tourism nominal Gross State Product (GSP) for all states and territories was $63 billion in 2022-23. This was up 77% on 2021-22 and up 4.4% on 2018-19. By comparison, nominal Gross Domestic Product (GDP) for the whole Australian economy in 2022-23 grew 11% on 2021‑22 and 32% on 2018-19.

Tourism’s direct share of the national economy was 2.5% in 2022-23. This remained a smaller share when compared with 2018-19, where it had a 3.1% direct share, due to the Australian economy as a whole growing stronger than just the tourism component when comparing 2022-23 with 2018-19.

Direct tourism GSP increased for all states and territories in 2022-23 compared with 2021-22 levels (Table 2). This growth varied across different jurisdictions:

- Australian Capital Territory – up 96% (or $0.7 billion)

- New South Wales – up 95% (or $9.1 billion)

- Victoria – up 85% (or $6.4 billion)

- South Australia – up 65% (or $1.5 billion)

- Queensland – up 64% (or $6.1 billion)

- Western Australia – up 64% (or $2.6 billion)

- Northern Territory – up 57% (or $0.4 billion)

- Tasmania – up 44% (or $0.5 billion).

Due to extended COVID-19 restrictions in Victoria, in 2022-23 GSP was still 5% lower than its pre-pandemic (2018-19) level. All other states and territories’ GSP were either at par or surpassed the pre-pandemic 2018-19 levels, with largest increase of 14% (or $2 billion) recorded in Queensland.

Table 2: Direct tourism GSP by state and territory, 2022-23

| State | GSP 2022-23 | Change from 2021-22 | Change from 2018-19 | ||

| $ billion | $ billion | Per cent | $ billion | Per cent | |

| New South Wales | 18.8 | 9.1 | 95% | 1.4 | 2.1% |

| Victoria | 13.9 | 6.4 | 85% | -0.7 | -4.7% |

| Queensland | 15.6 | 6.1 | 64% | 2.0 | 14% |

| South Australia | 3.8 | 1.5 | 65% | 0.3 | 7.8% |

| Western Australia | 6.5 | 2.6 | 64% | 0.6 | 9.3% |

| Tasmania | 1.7 | 0.5 | 44% | 0.0 | 0.5% |

| Northern Territory | 1.2 | 0.4 | 57% | 0.1 | 8.1% |

| Australian Capital Territory | 1.3 | 0.7 | 96% | 0.1 | 8.6% |

| Total | 63.0 | 27.3 | 77% | 2.7 | 4.4% |

Indirect tourism GSP for all states and territories was $65.7 billion in 2022-23. As a result, total GSP (direct plus indirect) was $128.7 billion in 2022-23. This indirect GSP contribution represented a 2.6% share of nominal national GDP in 2022-23. This compares with a 1.7% share in 2021-22 and a 3.3% share in 2018-19.

In measuring indirect GSP impacts, the increase on 2021-22 varied between 26% for Tasmania to 88% for the Australian Capital Territory. Queensland, South Australia, Western Australia, and the Australian Capital Territory all surpassed pre-pandemic levels (Table 3).

Table 3: Indirect tourism GSP by state and territory, 2022-23

| State | GSP 2022-23 | Change from 2021-22 | Change from 2018-19 | ||

| $ billion | $ billion | Per cent | $ billion | Per cent | |

| New South Wales | 19.5 | 9.0 | 86% | -0.2 | -1.2% |

| Victoria | 14.3 | 6.0 | 72% | -0.5 | -3.2% |

| Queensland | 16.1 | 5.6 | 53% | 1.7 | 12% |

| South Australia | 4.6 | 1.8 | 63% | 0.3 | 7.0% |

| Western Australia | 6.7 | 2.1 | 47% | 0.5 | 8.4% |

| Tasmania | 1.7 | 0.4 | 26% | -0.1 | -6.6% |

| Northern Territory | 1.4 | 0.5 | 49% | 0.0 | -3.1% |

| Australian Capital Territory | 1.4 | 0.6 | 88% | 0.1 | 8.8% |

| Total | 65.7 | 25.9 | 65% | 1.7 | 2.7% |

Tourism filled jobs

Since 2021-22, ABS (Australian Bureau of Statistics) has adopted ‘tourism filled jobs’ as the standard metric for reporting tourism employment. Therefore, the 2022-23 STSA also uses this metric for the second time (see explanatory notes for further information).

At the end of 2022-23, there were 626,200 direct tourism filled jobs, which was up 42% on the previous year. This compares with 4.9% growth in Australian jobs over the same period. As a result, tourism’s share of total filled jobs increased from 3.0% in 2021-22 to 4.1% in 2022-23. However, in 2018-19, before the COVID-19 pandemic, tourism provided 700,900 jobs, which was 5.1% of total jobs in Australia.

In addition to direct jobs, tourism generated a further 443,400 indirect jobs in the economy, resulting in a combined 1,069,600 direct and indirect jobs in the visitor economy. As a share of the economy, tourism’s indirect jobs share increased from 1.8% in 2021-22 to 2.9% in 2022-23. This share was 3.0% in 2018-19.

All states and territories had growth in direct and total (direct and indirect) tourism filled jobs in 2022-23 (Table 4).

Compared with 2018-19 levels, all states and territories had fewer direct tourism filled jobs in 2022-23. The deficits in direct tourism filled jobs in 2022-23 relative to the pre-pandemic level varied across jurisdictions, but was less than 20% in all cases:

- Tasmania (17%)

- New South Wales (15%)

- Victoria (15%)

- Northern Territory (10%)

- Western Australia (6.1%)

- Australian Capital Territory (5.2%)

- South Australia (5.1%)

- Queensland (3.0%).

Table 4: Tourism filled jobs by state and territory, 2022-23

| State | Tourism Jobs 2022-23 (000) | Change from 2021-22 (%) | Change from 2018-19 (%) | |||

| Direct jobs | Total jobs* | Direct jobs | Total jobs* | Direct jobs | Total jobs* | |

| New South Wales | 172.6 | 292.3 | 63% | 76% | -15% | -7.8% |

| Victoria | 163.6 | 257.5 | 50% | 62% | -15% | -9.5% |

| Queensland | 145.7 | 259.7 | 29% | 42% | -3.0% | 5.1% |

| South Australia | 40.6 | 69.8 | 32% | 45% | -5.1% | 1.9% |

| Western Australia | 66.7 | 110.8 | 24% | 35% | -6.1% | 0.9% |

| Tasmania | 19.0 | 42.9 | 10% | 21% | -17% | -8.6% |

| Northern Territory | 7.5 | 16.3 | 21% | 36% | -10% | -2.6% |

| Australian Capital Territory | 10.5 | 20.3 | 63% | 78% | -5.2% | 3.6% |

| Total | 626.2 | 1069.6 | 72% | 53% | -11% | -3.7% |

*Denotes direct and indirect tourism jobs

National summary

Total tourism GDP

$128.7 billion

Up 71% compared with 2021–22

Up 3.5% compared with 2018–19

Total tourism GVA

$115.3 billion

Up 74% compared with 2021–22

Up 4.6% compared with 2018–19

Total tourism filled jobs

1.07 million

Up 53% compared with 2021–22

Down 3.7% compared with 2018–19

Tourism GDP

In 2022–23:

- direct tourism GDP in Australia was worth $63.0 billion (up 77% on 2021-22 and up 4.4% on 2018-19)

- this was a 2.5% direct share of total territory GSP (up 0.9 % on 2021-22 and down 0.6 % on 2018-19)

- total national GDP was worth $2561.2 billion (up 9.8% on 2021-22 and up 31% on 2018-19)

- indirect tourism GDP was worth an extra $65.7 billion to the Australian economy (up 65% on 2021-22 and up 2.7% on 2018-19)

- total tourism GDP (both direct and indirect) was worth $128.7 billion to the Australian economy (up 71% on 2021-22 and up 3.5% on 2018-19)

Tourism GVA

In 2022–23:

- direct tourism GVA in Australia was worth $57.2 billion (up 75% on 2021-22 and up 3.7% on 2018-19)

- this was a 2.4% direct share of total national GVA (up 0.9 % on 2021-22 and down 0.7 % on 2018-19)

- total GVA in Australia was worth $2406.8 billion (up 10% on 2021-22 and up 32% on 2018-19)

- indirect tourism GVA was worth an extra $58.1 billion to the Australian economy (up 73% on 2021-22 and up 5.5% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $115.3 billion to the Australian economy (up 74% on 2021-22 and up 4.6% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in Australia totalled 626,200 (up 42% on 2021-22 and down 11% on 2018-19)

- this was a 4.1% direct share of total filled jobs (up 1.1 % on 2021-22 and down 0.9% on 2018-19)

- total filled jobs in Australia amounted to 15.2 million (up 4.9% on 2021-22 and up 9.8% on 2018-19)

- indirectly tourism added a further 443,400 jobs in Australia (up 74% on 2021-22 and up 8.3% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 1.07 million in the Australian economy (up 53% on 2021-22 and down 3.7% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in Australia, this money wouldn’t be generated, or these people wouldn’t be employed, in this way.

What is indirect contribution?

The flow-on effect of the tourism industry. Based on 2022-23 direct tourism output data from the National TSA (ABS Cat. No 5249.0), in Australia, for every dollar spent in the tourism industry, an additional 84 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA?

GVA allows easier comparisons across industries. GVA is equal to GDP minus taxes.

Australian Capital Territory summary

Total tourism GSP

$2.7 billion

Up 92% compared with 2021–22

Up 8.7% compared with 2018–19

Total tourism GVA

$2.4 billion

Up 94% compared with 2021–22

Up 9.5% compared with 2018–19

Total tourism filled jobs

20,300

Up 78% compared with 2021–22

Up 3.6% compared with 2018–19

Tourism GSP

In 2022–23:

- direct tourism GSP in the ACT (Australian Capital Territory) was worth $1.3 billion (up 96% on 2021-22 and up 8.6% on 2018-19)

- this was a 2.6% direct share of total territory GSP (up 1.1 % on 2021-22 and down 0.4 % on 2018-19)

- total territory GSP was worth $51.2 billion (up 10% on 2021-22 and up 27% on 2018-19)

- indirect tourism GSP was worth an extra $1.4 billion to the ACT economy (up 88% on 2021-22 and up 8.8% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $2.7 billion to the ACT economy (up 92% on 2021-22 and up 8.7% on 2018-19)

Tourism GVA

In 2022–23:

- direct tourism GVA in the ACT was worth $1.2 billion (up 94% on 2021-22 and up 8.2% on 2018-19)

- this was a 2.5% direct share of total territory GVA (up 1.1 % on 2021-22 and down 0.5 % on 2018-19)

- total territory GVA was worth $49 billion (up 11% on 2021-22 and up 29% on 2018-19)

- indirect tourism GVA was worth an extra $1.2 billion to the ACT economy (up 94% on 2021-22 and up 11% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $2.4 billion to the ACT economy (up 94% on 2021-22 and up 9.5% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in the ACT totalled 10,500 (up 63% on 2021-22 and down 5.2% on 2018-19)

- this was a 3.9% direct share of total territory filled jobs (up 1.4 % on 2021-22 and down 0.6% on 2018-19)

- total territory filled jobs amounted to 270,700 (up 5.1% on 2021-22 and up 10% on 2018-19)

- indirectly tourism added a further 9,800 jobs in the ACT (up 97% on 2021-22 and up 15% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 20,300 in the ACT (up 78% on 2021-22 and up 3.6% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in the ACT, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In the ACT, for every dollar spent in the tourism industry, an additional 80 cents of related expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

New South Wales summary

Total tourism GSP

$38.2 billion

Up 90% compared with 2021–22

Up 0.4% compared with 2018–19

Total tourism GVA

$34.3 billion

Up 93% compared with 2021–22

Up 1.6% compared with 2018–19

Total tourism filled jobs

292,300

Up 76% compared with 2021–22

Down 7.8% compared with 2018–19

Tourism GSP

In 2022–23:

- direct tourism GSP in New South Wales was worth $18.8 billion (up 95% on 2021-22 and up 2.1% on 2018-19)

- this was a 2.4% direct share of total state GSP (up 1.0% on 2021-22 and down 0.5% on 2018-19)

- total state GSP was worth $777.3 billion (up 11% on 2021-22 and up 24% on 2018-19)

- indirect tourism GSP was worth an extra $19.5 billion to the New South Wales economy (up 86% on 2021-22 and down 1.2% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $38.2 billion to the New South Wales economy (up 90% on 2021-22 and up 0.4% on 2018-19)

Tourism GVA

In 2022–23:

- direct tourism GVA in New South Wales was worth $17.1 billion (up 92% on 2021-22 and up 1.6% on 2018-19)

- this was a 2.4% direct share of total state GVA (up 1.0% on 2021-22 and down 0.5% on 2018-19)

- total state GVA was worth $723.6 billion (up 13% on 2021-22 and up 25% on 2018-19)

- indirect tourism GVA was worth an extra $17.2 billion to the New South Wales economy (up 95% on 2021-22 and up 1.6% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $34.3 billion to the New South Wales economy (up 93% on 2021-22 and up 1.6% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in New South Wales totalled 172,600 (up 63% on 2021-22 and down 15% on 2018-19)

- this was a 3.6% direct share of total state’s filled jobs (up 1.3% on 2021-22 and down 1.0% on 2018-19)

- total state filled jobs amounted to 4.8 million (up 6.2% on 2021-22 and up 8.2% on 2018-19)

- indirectly tourism added a further 119,700 jobs in New South Wales (up 99% on 2021-22 and up 4.2% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 292,300 in New South Wales (up 76% on 2021-22 and down 7.8% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in NSW (New South Wales), this money wouldn’t be generated, or these people wouldn’t be employed, in this way.

What is indirect contribution?

The flow-on effect of the tourism industry. In NSW, for every dollar spent in the tourism industry, an additional 84 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA?

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Northern Territory summary

Total tourism GSP

$2.6 billion

Up 52% compared with 2021–22

Up 1.8% compared with 2018–19

Total tourism GVA

$2.2 billion

Up 53% compared with 2021–22

Down 4.5% compared with 2018–19

Total tourism filled jobs

16,300

Up 36% compared with 2021–22

Down 2.6% compared with 2018–19

Tourism GSP

In 2022–23:

- direct tourism GSP in the NT (Northern Territory) was worth $1.2 billion (up 57% on 2021-22 and up 8.1% on 2018-19)

- this was a 3.8% direct share of total territory GSP (up 1.2% on 2021-22 and down 0.8% on 2018-19)

- total territory GSP was worth $32.6 billion (up 5.0% on 2021-22 and up 30% on 2018-19)

- indirect tourism GSP was worth an extra $1.4 billion to the NT economy (up 49% on 2021-22 and down 3.1% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $2.6 billion to the NT economy (up 52% on 2021-22 and up 1.8% on 2018-19).

Tourism GVA

In 2022–23:

- direct tourism GVA in the NT was worth $1.1 billion (up 55% on 2021-22 and up 7.0% on 2018-19)

- this was a 3.6% direct share of total territory GVA (up 1.1% on 2021-22 and down 0.8% on 2018-19)

- total territory GVA was worth $31.1 billion (up 5.1% on 2021-22 and up 30% on 2018-19)

- indirect tourism GVA was worth an extra $1.1 billion to the NT economy (up 50% on 2021-22 and up 2.3% on 2018-19).

- total tourism GVA (both direct and indirect) was worth $2.2 billion to the NT economy (up 53% on 2021-22 and up 4.5% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in the NT totalled 7,500 (up 21% on 2021-22 and down 10% on 2018-19)

- this was a 5.0% direct share of total territory filled jobs (up 0.7% on 2021-22 and down 1.2% on 2018-19)

- total territory filled jobs amounted to 150,000 (up 4.2% on 2021-22 and up 11% on 2018-19)

- indirectly tourism added a further 8,800 jobs in the NT (up 51% on 2021-22 and up 5.7% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 16,300 in the NT (up 36% on 2021-22 and down 2.6% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in the NT, this money wouldn’t be generated, or these people wouldn’t be employed, in this way.

What is indirect contribution?

The flow-on effect of the tourism industry. In the NT, for every dollar spent in the tourism industry, an additional 83 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA?

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Queensland summary

Total tourism GSP

$31.8 billion

Up 58% compared with 2021–22

Up 13% compared with 2018–19

Total tourism GVA

$28.6 billion

Up 61% compared with 2021–22

Up 14% compared with 2018–19

Total tourism filled jobs

259,700

Up 42% compared with 2021–22

Up 5.1% compared with 2018–19

Tourism GSP

In 2022–23:

- direct tourism GSP in Queensland was worth $15.6 billion (up 64% on 2021-22 and up 14% on 2018-19)

- this was a 3.1% direct share of total state GSP (up 1.0% on 2021-22 and down 0.6% on 2018-19)

- total state GSP was worth $503.4 billion (up 13% on 2021-22 and up 37% on 2018-19)

- indirect tourism GSP was worth an extra $16.1 billion to the Queensland economy (up 53% on 2021-22 and up 12% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $31.8 billion to the Queensland economy (up 58% on 2021-22 and up 13% on 2018-19).

Tourism GVA

In 2022–23:

- direct tourism GVA in Queensland was worth $14.2 billion (up 62% on 2021-22 and up 13% on 2018-19)

- this was a 3.0% direct share of total state GVA (up 0.9% on 2021-22 and down 0.6% on 2018-19)

- total state GVA was worth $473.4 billion (up 13% on 2021-22 and up 37% on 2018-19)

- indirect tourism GVA was worth an extra $14.4 billion to the Queensland economy (up 60% on 2021-22 and up 15% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $28.6 billion to the Queensland economy (up 61% on 2021-22 and up 14% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in Queensland totalled 145,700 (up 29% on 2021-22 and down 3.0% on 2018-19)

- this was a 4.7% direct share of total state’s filled jobs (up 0.9% on 2021-22 and down 0.6% on 2018-19)

- total state filled jobs amounted to 3.1 million (up 3.4% on 2021-22 and up 9.0% on 2018-19)

- indirectly tourism added a further 114,000 jobs in Queensland (up 63% on 2021-22 and up 18% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 259,700 in Queensland (up 42% on 2021-22 and up 5.1% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in Qld, this money wouldn’t be generated, or these people wouldn’t be employed, in this way.

What is indirect contribution?

The flow-on effect of the tourism industry. In Qld, for every dollar spent in the tourism industry, an additional 86 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA?

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

South Australia summary

Total tourism GSP

$8.4 billion

Up 64% compared with 2021–22

Up 7.4% compared with 2018–19

Total tourism GVA

$7.1 billion

Up 64% compared with 2021–22

Up 8.8% compared with 2018–19

Total tourism filled jobs

69,800

Up 45% compared with 2021–22

Up 1.9% compared with 2018–19

Tourism GSP

In 2022–23:

- direct tourism GSP in South Australia was worth $3.8 billion (up 65% on 2021-22 and up 7.8% on 2018-19)

- this was a 2.7% direct share of total state GSP (up 0.9% from 2021-22 and down 0.5% on 2018-19)

- total state GSP was worth $142.0 billion (up 10% on 2021-22 and up 30% on 2018-19)

- indirect tourism GSP was worth an extra $4.6 billion to the South Australian economy (up 63% on 2021-22 and up 7.0% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $8.4 billion to the South Australian economy (up 64% on 2021-22 and up 7.4% on 2018-19).

Tourism GVA

In 2022–23:

- direct tourism GVA in South Australia was worth $3.5 billion (up 63% on 2021-22 and up 6.9% on 2018-19)

- this was a 2.6% direct share of total state GVA (up 0.8% on 2021-22 and down 0.6% on 2018-19)

- total state GVA was worth $133.3 billion (up 11% on 2021-22 and up 31% on 2018-19)

- indirect tourism GVA was worth an extra $3.6 billion to the South Australian economy (up 65% on 2021-22 and up 11% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $7.1 billion to the South Australian economy (up 64% on 2021-22 and up 8.8% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in South Australia totalled 40,600 (up 32% on 2021-22 and down 5.1% on 2018-19)

- this was a 4.0% direct share of total state’s filled jobs (up 0.9% on 2021-22 and down 0.7% on 2018-19)

- total state filled jobs amounted to 1.0 million (up 3.3% on 2021-22 and up 11% on 2018-19)

- indirectly tourism added a further 29,200 jobs in South Australia (up 68% on 2021-22 and up 14% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 69,800 in South Australia (up 45% on 2021-22 and up 1.9% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in SA (South Australia), this money wouldn’t be generated, or these people wouldn’t be employed, in this way.

What is indirect contribution?

The flow-on effect of the tourism industry. In SA, for every dollar spent in the tourism industry, an additional 83 cents were spent elsewhere in the economy.

Why we use GVA?

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Tasmania summary

Total tourism GSP

$3.5 billion

Up 35% compared with 2021–22

Down 3.2% compared with 2018–19

Total tourism GVA

$3.2 billion

Up 37% compared with 2021–22

Down 1.6% compared with 2018–19

Total tourism filled jobs

42,900

Up 21% compared with 2020–21

Down 8.6% compared with 2018–19

Tourism GSP

In 2022–23:

- direct tourism GSP in Tasmania was worth $1.7 billion (up 44% on 2021-22 and up 0.5% on 2018-19)

- this was a 4.3% direct share of total state GSP (up 1.2% on 2021-22 and down 1.1% on 2018-19)

- total state GSP was worth $40.5 billion (up 5.3% on 2021-22 and up 27% on 2018-19)

- indirect tourism GSP was worth an extra $1.7 billion to the Tasmanian economy (up 26% on 2021-22 and down 6.6% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $3.5 billion to the Tasmanian economy (up 35% on 2021-22 and down 3.2% on 2018-19).

Tourism GVA

In 2022–23:

- direct tourism GVA in Tasmania was worth $1.6 billion (up 43% on 2021-22 and down 0.1% on 2018-19)

- this was a 4.1% direct share of total state GVA (up 1.1% on 2021-22 and down 1.1 % on 2018-19)

- total state GVA was worth $38 billion (up 5.1% on 2021-22 and up 27% on 2018-19)

- indirect tourism GVA was worth an extra $1.6 billion to the Tasmanian economy (up 33% on 2021-22 and down 3.1% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $3.2 billion to the Tasmanian economy (up 37% on 2021-22 and down 1.6% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in Tasmania totalled 19,000 (up 10% on 2021-22 and down 17% on 2018-19)

- this was a 5.8% direct share of total state’s filled jobs (up 0.4% on 2021-22 and down 2.0% on 2018-19)

- total state filled jobs amounted to 329,000 (up 2.2% on 2021-22 and up 12% on 2018-19)

- indirectly tourism added a further 23,900 jobs in Tasmania (up 31% on 2021-22 and down 0.7% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 42,900 in Tasmania (up 21% on 2021-22 and down 8.6% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in Tas, this money wouldn’t be generated, or these people wouldn’t be employed, in this way.

What is indirect contribution?

The flow-on effect of the tourism industry. In Tas, for every dollar spent in the tourism industry, an additional 83 cents were spent elsewhere in the economy.

Why we use GVA?

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Victoria summary

Total tourism GSP

$28.2 billion

Up 78% compared with 2021–22

Down 4.0% compared with 2018–19

Total tourism GVA

$25.5 billion

Up 82% compared with 2021–22

Down 3.4% compared with 2018–19

Total tourism filled jobs

257,500

Up 62% compared with 2021–22

Down 9.5% compared with 2018–19

Tourism GSP

In 2022–23:

- direct tourism GSP in Victoria was worth $13.9 billion (up 85% on 2021-22 and down 4.7% on 2018-19)

- this was a 2.4% direct share of total state GSP (up 1.0% on 2021-22 and down 0.7 % on 2018-19)

- total state GSP was worth $569 billion (up 10% on 2021-22 and up 23% on 2018-19)

- indirect tourism GSP was worth an extra $14.3 billion to the Victorian economy (up 72% on 2021-22 and down 3.2% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $28.2 billion to the Victorian economy (up 78% on 2021-22 and down 4.0% on 2018-19).

Tourism GVA

In 2022–23:

- direct tourism GVA in Victoria was worth $12.6 billion (up 82% on 2021-22 and down 5.7% on 2018-19)

- this was a 2.4% direct share of total state GVA (up 0.9% on 2021-22 and down 0.8% on 2018-19)

- total state GVA was worth $529.0 billion (up 11% on 2021-22 and up 24% on 2018-19)

- indirect tourism GVA was worth an extra $12.9 billion to the Victorian economy (up 82% on 2021-22 and down 1.1% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $25.5 billion to the Victorian economy (up 82% on 2021-22 and down 3.4% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in Victoria totalled 163,600 jobs (up 50% on 2021-22 and down 15% on 2018-19)

- this was a 4.2% direct share of total state’s filled jobs (up 1.2% on 2021-22 and down 1.3% on 2018-19)

- total state filled jobs amounted to 3.9 million (up 6.1% on 2021-22 and up 11% on 2018-19)

- indirectly tourism added a further 93,900 jobs in Victoria (up 86% 2021-22 and up 1.3% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled for 257,500 jobs in Victoria (up 62% on 2021-22 and down 9.5% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in Victoria, this money wouldn’t be generated, or these people wouldn’t be employed, in this way.

What is indirect contribution?

The flow-on effect of the tourism industry. In Victoria, for every dollar spent in the tourism industry, an additional 85 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA?

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Western Australia summary

Total tourism GSP

$13.2 billion

Up 55% compared with 2021–22

Up 8.8% compared with 2018–19

Total tourism GVA

$11.9 billion

Up 59% compared with 2021–22

Up 10% compared with 2018–19

Total tourism filled jobs

110,800

Up 35% compared with 2021–22

Up 0.9% compared with 2018–19

Tourism GSP

In 2022–23:

- direct tourism GSP in Western Australia was worth $6.5 billion (up 64% on 2021-22 and up 9.3% on 2018-19)

- this was a 1.5% direct share of total state GSP (up 0.5% on 2021-22 and down 0.6% on 2018-19)

- total state GSP was worth $445.3 billion (up 10% on 2021-22 and up 55% on 2018-19)

- indirect tourism GSP was worth an extra $6.7 billion to the Western Australian economy (up 47% on 2021-22 and up 8.4% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $13.2 billion to the Western Australian economy (up 55% on 2021-22 and up 8.8% on 2018-19).

Tourism GVA

In 2022–23:

- direct tourism GVA in Western Australia was worth $5.9 billion (up 63% on 2021-22 and up 8.7% on 2018-19)

- this was a 1.4% direct share of total state GVA (up 0.5% on 2021-22 and down 0.6% on 2018-19)

- total state GVA was worth $429.4 billion (up 10% on 2021-22 and up 55% on 2018-19)

- indirect tourism GVA was worth an extra $6.0 billion to the Western Australian economy (up 55% on 2021-22 and up 11% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $11.9 billion to the Western Australian economy (up 59% on 2021-22 and up 10% on 2018-19).

Tourism filled jobs

In 2022–23:

- direct tourism filled jobs in Western Australia totalled 66,700 jobs (up 24% on 2021-22 and down 6.1% on 2018-19)

- this was a 4.1% direct share of total state’s filled jobs (up 0.7% on 2021-22 and down 0.7% on 2018-19)

- total state filled jobs amounted to 1.6 million (up 3.2% on 2021-22 and up 11% on 2018-19)

- indirectly tourism added a further 44,000 jobs in Western Australia (up 57% on 2021-22 and up 14% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled for 110,800 in Western Australia (up 35% on 2021-22 and up 0.9% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in WA (Western Australia), this money wouldn’t be generated, or these people wouldn’t be employed, in this way.

What is indirect contribution?

The flow-on effect of the tourism industry. In WA, for every dollar spent in the tourism industry, an additional 81 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA?

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Data tables

Find out more about tourism consumption, jobs and economic activity in our data tables.

Changes in this issue

ABS has implemented changes to the methodology of deriving tourism output at basic prices, tourism taxes on products, tourism margins and tourism imports. As a result, revision to the data at national level has been applied to previous annual coefficient benchmark i.e. 2019-20. For further information on these revisions please see history-of-changes. These revisions have also reflected changes in state tourism satellite Accounts estimates from 2019-10 to 2021-22 published in the State Tourism Satellite Account, 2021-22 publication.

Explanatory notes

Revisions to the Australian Bureau of Statistics’ (ABS) national accounts data have an impact on the STSA. The ABS makes periodical revisions to reflect changes in the economy, in line with international best practice. ABS has embarked upon updating input-output relationships based on the latest available supply-use tables, which in this case refer to year 2020-21 which reflect in revision of some benchmark ratios and some imputed ratios for the indicators which were not available.

Some unwarranted fluctuations observed in the previously published 2021-22 and 2020-21 STSA results. Upon investigation it was found that underlying IVS expenditure ratios used in the model were incorrect (deficient) for these two years because of the non-availability of underlying IVS data due to COVID-19 restrictions. To fix this issue, in the current cycle we have used IVS expenditure ratios available in the 2019-20 for these two intervening years.

Regional expenditure data from TRA surveys are widely used in deriving proportions for disaggregating National TSA data across jurisdictions and across visitor types. These data are sourced from the International Visitor Survey (IVS) and National Visitor Survey (NVS), year ending June 2023.

Methodology

The 2022–23 STSA publication presents a comprehensive set of data on the direct and indirect economic contribution of tourism for all states and territories. It builds on the Australian Bureau of Statistics’ (ABS) Australian Tourism Satellite Account.

The report highlights changes in 2022–23, in nominal terms. It also examines longer term patterns in tourism’s contribution to the national, state and territory economies.

Australian System of National Accounts

The Australian System of National Accounts (SNA) is based on industry classifications. Industries within the SNA are characterised by their production or ‘supply’ capacity. Tourism, on the other hand, is a demand-side concept and so has no direct industry supply characteristics distinguishable from the SNA.

The Australian TSA bridges the supply-demand gap. It:

- measures the economic contribution of tourism

- supplements the SNA.

Comparisons can then be made between:

- the tourism sector’s economic contribution, and

- conventional industries’ contribution within an economy.

The TSA also enables comparison between Australian and international tourism sectors.

Check the ABS Australian National Accounts: Tourism Satellite Account methodology for more information on the National TSA.

Sources for data and methodology

The approach in this STSA is to derive the direct contribution of tourism. It is similar to the approach developed by Pham et al. (2009). Tourism spend data and state/territory industry input-output (I-O) data are combined with the National TSA benchmark. This is to capture the:

- supply of tourism at the state/territory level

- demand for tourism at the state/territory level.

The main sources for the data and methodology are:

- unpublished modelled regional expenditure data from Tourism Research Australia’s:

- International Visitor Survey (IVS)

- National Visitor Survey (NVS).

- I-O database from The Enormous Regional Model (Horridge, Madden & Wittwer, 2003).

- National TSA produced by the ABS (2021).

- Pham, T.D., L. Dwyer and R. Spurr (2009) ‘Constructing a regional TSA: The case of Queensland’, Tourism Analysis, 13, 5/6, pp. 445-460.

- Pham, T.D. and Dwyer, L. (2013), ‘Tourism Satellite Account and Its applications in CGE Modelling’, in Tisdell (ed), The Handbook of Tourism Economics – Analysis, New Applications and Case Studies, Chapter 22, World Scientific Publishing.

- Dwyer, L. and Pham, T.D. (2012), ‘CGE Modelling’, in Dwyer, Gill and Seetaram (eds), Research Methods in Tourism, Chapter 13, Edward Elgar Publishing.

Indirect and total contribution of tourism

Indirect effects of tourism demand on businesses that provide goods and services to the tourism industry are also measured. For example, the indirect tourism demand generated from supplying a meal to a visitor starts with producing those goods and services the restaurant needs to make the meal. This might include fresh produce and electricity for cooking.

This approach complements the direct effects presented through the TSA framework. It provides a clearer picture of the total contribution of tourism to the economy. Indirect contributions have been calculated using I-O analysis methods. This is because the TSA framework is not designed to measure these indirect effects at state and territory level.

The I-O analysis methods provide a breakdown of the supply and demand of commodities in the Australian economy.

Multipliers for calculating tourism’s indirect effects

Multipliers for standard industries in the Australian and New Zealand Standard Industry Classification (ANZSIC) are used as the basis for calculating tourism’s indirect effects. This is because the tourism sector does not represent a single industry in the economy.