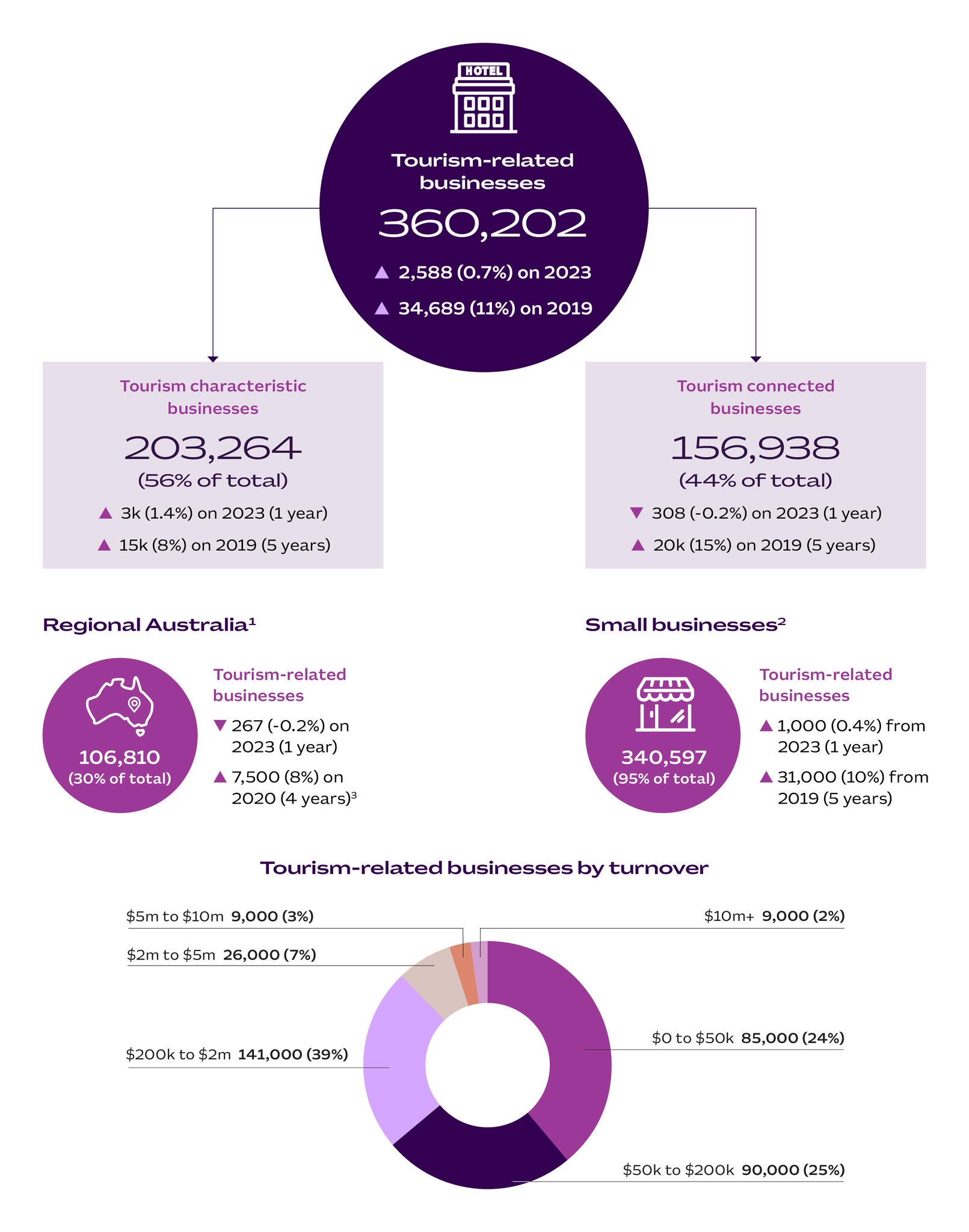

The infographic above shows tourism business statistics including total number of businesses. The division is between tourism-characteristic, tourism-connected industries, proportion of businesses in regional Australia, number of small businesses, and tourism businesses by turnover. Statistics as follows:

- There were a total of 360,202 tourism-related businesses in Australia in June 2024. This is an increase of 2,588 business (0.7%) on last year (June 2023) and an 11% increase (35,000 business) on June 2019.

- 56% of tourism-related businesses are from tourism-characteristic industries, while the other 44% are from tourism-connected industries.

- The number of tourism-characteristic businesses has increased by 1.4% since June 2023 and by 8% since 2019.

- The number of tourism-connected businesses has decreased by 0.2% since June 2023 but increased by 15% since 2019.

- Regional Australia stats: 30% of tourism-related businesses are located in regional Australia. This is up from 28% in 2019.

- Small businesses stats: 95% of tourism-related businesses are classified as small (with less than 20 employees including non-employing businesses). This is an increase of 0.4% on June and an increase of 10% on 5 years ago (June 2019).

The most common turnover range of tourism-related businesses in 2023-24 (encompassing 39% of businesses) was $200,000 to $2 million. Next were $50,000 to $200,000 (with 25%) and $0 to $50,000 (with 24%). Businesses with turnover greater than $2 million accounted for only 12% (7% for $2 million to $5 million; 3% for $5 million to $10 million and 2% for over $10 million).